Dakotas UM pass resolution on predatory lending

Predatory lending is a term used to describe a wide range of unfair financial practices. Here are some resources that can help you avoid being a victim.

Predatory lending is a term used to describe a wide range of unfair financial practices. Here are some resources that can help you avoid being a victim.

"Payday industry executives admitted last year South Dakota is the Wild West when it comes to high-interest lending," said Rep. Steve Hickey (R-District 9) is serving his third term in the South Dakota House of Representatives. An ordained minister, he has served for 21 years as the founding pastor of Church at the Gate in Sioux Falls. "In the early 1980s, Gov. Bill Janklow repealed our interest rate cap to bring in 400 Citibank jobs. He later said he was after 400 jobs and certainly not 20 percent interest rates, which he called unhealthy."

Today, interest rates of 300 percent to more than 600 percent are common here. Last year, the Sioux Falls Business Journal reported 56 payday/title loan shops just in Sioux Falls area. Predatory lenders often leave people worse off than before and the taxpayers clean up the mess.

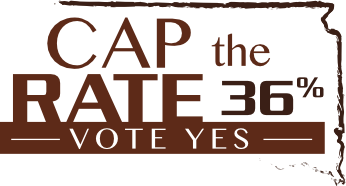

South Dakotans for Responsible Lending is a bi-partisan coalition that seeks to cap payday, car title, and installment loans at an annual interest rate of 36%. That number was carefully chosen. In 2006 Congress determined that 36% was the maximum interest rate a person could dig out from on his or her own. As a result, Congress capped payday and title loans to active duty military personnel at 36%. The fear was that higher rates undermined our nation’s military readiness. A similar cap is already in place in 15 states and the District of Columbia. Other states, such as Vermont and Georgia, simply prohibit payday lending entirely.

Members of the 23rd session of the Dakotas Annual Conference passed a resolution to become a partner and support the efforts of South Dakotans for Responsible Lending. Here is the exact wording of the resolution:

WHEREAS, Scripture teaches that all persons are of sacred worth (Genesis 1:26); and

WHEREAS, Scripture teaches that the people of God are not to take advantage of the weak, the poor, and the vulnerable (Exodus 22:21–24; Deuteronomy 24:10–22; Zechariah 7:8–14); and

WHEREAS some financial institutions exploit financially struggling households by charging excessive rates of interest on cash advances, payday loans, car title loans, direct deposit advances, and high-cost installment loans; and

WHEREAS, The Book of Discipline of the United Methodist Church states in the Social Principles:

“Financial institutions serve a vital role in society. They must guard, however, against abusive and deceptive lending practices that take advantage of the neediest among us for the gain of the richest.

Banking regulations must prevent the collection of usurious interest that keeps people in cycles of debt.” (Social Principles, 163J Finance); and

WHEREAS, The United Methodist Church directs all general agencies to invest in banks that have “policies and practices that preclude predatory or harmful lending practices” (Resolution 4071); and

BE IT THEREFORE RESOLVED that the Dakotas Conference of The United

Methodist Church sign on as a coalition partner with South Dakotans for Responsible Lending and join in advocating to cap payday, car title, and installment loans at an annual interest rate of 36%.

To learn more about South Dakotans Responsible for Lending visit their website or Facebook page.